What Does It Mean to Provide a Fair Inheritance to Your Beneficiaries? Part 1 of 3

By: Cristin Gerczak, Esq.

January 19, 2021

During the estate planning process, it can be difficult deciding not only on your beneficiaries, but also asset distribution. Heirs frequently (and erroneously) believe that they should have a say in this, but the ultimate decision is always up to the person creating the estate plan.

In this first in a series of posts on fair inheritance, we’re going to cover the general idea of “fairness” and what you should consider when planning how to distribute your assets. Part two will focus on the impact of your relationship status, and part three will dive into the importance of family communication.

Fair Distribution vs. Equal Distribution: Estate Planning Complexities

Importantly, creating a fair or equitable distribution does not always mean an equal distribution. There are many family and business complexities to take into consideration in planning the distribution of your estate assets, such as which children are actively involved in the business and in what ways they are involved.

Blended families are another example of a sensitive matter in selecting beneficiaries and distribution. In some situations, one child may be more involved in a family business than others, which might tip the balance in creating a “fair” inheritance. Or perhaps there is an estranged relative that you would prefer to disinherit. These examples are only the tip of the iceberg.

What Do Heirs Think Is Fair?

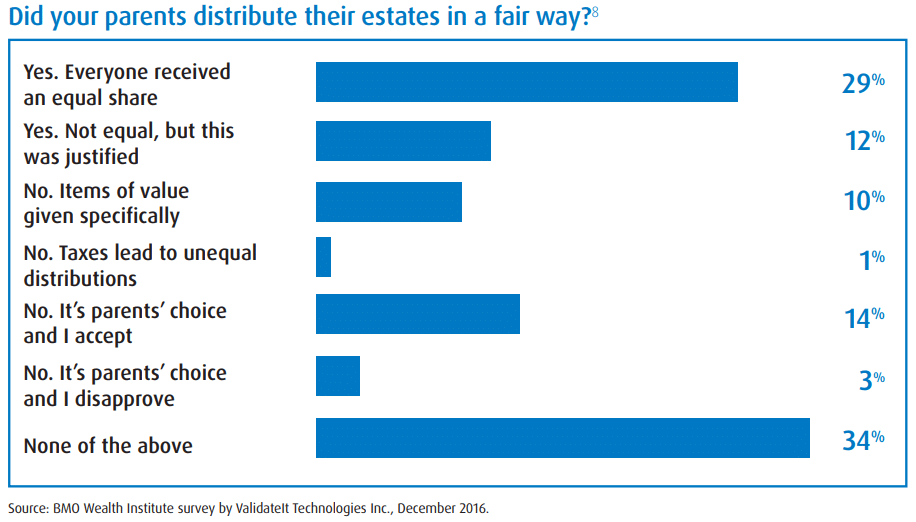

This chart represents the results of a survey conducted on whether parents’ distributions were viewed as fair by heirs:

As you can see, there is a wide range of opinions on how parents’ estates are distributed. Because of this, though the distribution decision is ultimately up to you during the estate planning process, it can be hard not to take into consideration how your children or heirs will feel once they receive — or don’t receive — an inheritance.

In order to properly address these concerns and minimize court costs and conflict later, you should consider discussing your specific estate complexities and motives with an experienced Florida estate planning attorney. Check back soon for part two of our fair inheritance series, which will go over how your relationship status can impact estate planning.

Author:

Cristin Gerczak, Esq.

Haimo Law

Strategic Planning With Purpose®

Email: cgerczak@haimolaw.com

YouTube: http://www.youtube.com/user/haimolawtv

YOU ARE NOT OUR CLIENT UNLESS WE EXECUTE A WRITTEN AGREEMENT TO THAT EFFECT. MOREOVER, THE INFORMATION CONTAINED HEREIN IS INTENDED FOR INFORMATIONAL PURPOSES ONLY. EACH SITUATION IS HIGHLY FACT SPECIFIC AND EXCEPTIONS OFTEN EXIST TO GENERAL RULES. DO NOT RELY ON THIS INFORMATION, AS A CONSULTATION TO UNDERSTAND THE FACTS AND THE CLIENT’S NEEDS AND GOALS IS NECESSARY. ULTIMATELY WE MUST BE RETAINED TO PROVIDE LEGAL ADVICE AND REPRESENTATION. THIS INFORMATION IS PROVIDED AS A COURTESY AND, ACCORDINGLY, DOES NOT CONSTITUTE LEGAL ADVICE.